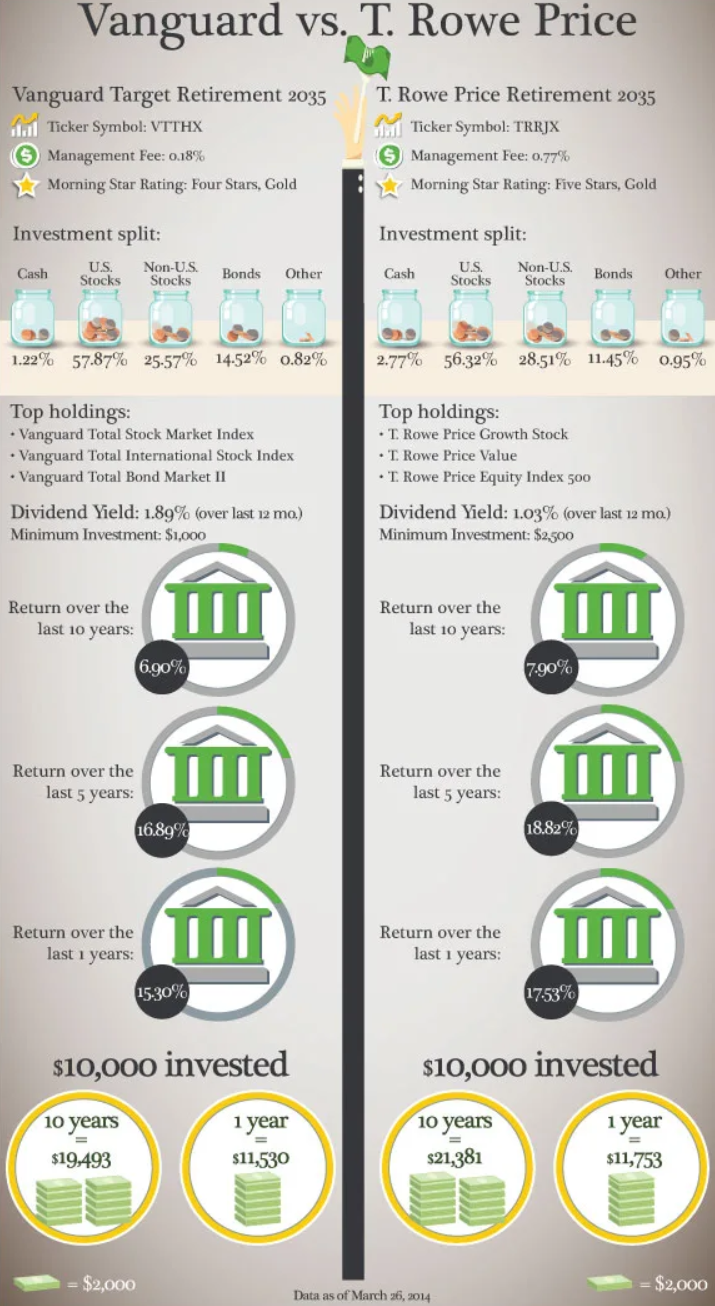

2035 Target Date Funds

Lead and T. Rowe Cost offer 2 of the most highly regarded 2035 time frame funds around.

But which one is the very best if you have to choose one for your retirement fund?

Target date funds are an excellent option for all savers due to the fact that they are diversified accounts with a mix of stocks as well as bonds, residential and also international, which take into consideration your age.

When you’re young and also there’s great deals of time to come through the market’s ups and downs, time frame funds spend extra greatly in stocks to improve returns.

As you obtain closer to retirement, the funds reduce their susceptability to wild swings in the stock market by investing a lot more greatly in bonds.

Lead Target Retirement 2035 as well as T. Rowe Rate Retirement 2035 are aimed at savers that remain in their very early 40s and planning to retire about two decades from now.

Therefore, more than 80% of both target date funds are bought stocks through various other common funds that Vanguard and also T. Rowe Rate own as well as manage.

The primary UNITED STATE stock fund used by Vanguard’s 2035 target date fund (Lead Total amount Stock Market Index) holds shares in greater than 3,000 companies in an attempt to comply with wide market trends.

The greatest investment by T. Rowe Cost’s 2035 fund (T. Rowe Rate Growth Supply Fund) holds simply over 100 firms that it hopes will create better-than-average market returns.

Below’s how that distinction in investing viewpoint has actually developed tiny yet significant differences worth considering.

If you’re believing this is a tough phone call, you’re absolutely right.

When I ran those numbers by a couple of reputable money managers, they differed on which fund they ‘d select for their customers.

Steve Krawick, head of state of West Chester Capital Advisors in Johnstown, Pa., favors T. Rowe Rate, largely based on the consistently higher rate of return. Even though it charges a greater fee, T. Rowe did well adequate to greater than make up the distinction.

The fund additionally simply celebrated its 10th birthday, and, he claims, has had the exact same investment supervisor over the long run. “If you have somebody that’s been with the investment considering that its inception, he obtains credit permanently outcomes as well as criticize for bad results yet overall it’s been great,” Krawick claims.

Costs DeShurko, portfolio supervisor at Boston-based Covestor.com and also writer of The Naked Truth concerning Your Money, would pick the Lead fund.

” It does have the lower return, yet likewise a somewhat reduced risk account,” he claims.

DeShurko also notes that Lead’s returns yield is plainly higher, which suggests its holdings have actually made a lot more returns and also passion over the past year.

” While unexceptional, the high yield from the Vanguard fund provides me an expectation of that moving forward,” DeShurko says. “As the fund changes its appropriation, the return ought to increase toward retirement. As well as while you’re in the build-up setting, the higher the returns to reinvest, the better.”

So that wins this Fund Battle?

My initial response would be to choose Vanguard as well as its lower fees and greater returns return.

Yet T. Rowe Cost has posted the far better general return (rewards, passion and also share cost recognition) over the previous one decade.

Can it maintain that up? You never know.

However the Gen X investors in this target date fund have two critical decades entrusted to develop their savings, and I believe the additional return is worth the moderate extra risk.

I ‘d place the T. Rowe Rate Retirement 2035 fund in my retirement plan.